A Comprehensive Guide to Understanding and Investing in PP Jewellers: A Detailed Analysis

Related Articles: A Comprehensive Guide to Understanding and Investing in PP Jewellers: A Detailed Analysis

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to A Comprehensive Guide to Understanding and Investing in PP Jewellers: A Detailed Analysis. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

A Comprehensive Guide to Understanding and Investing in PP Jewellers: A Detailed Analysis

Introduction

In the world of finance, investing in the stock market can be a complex and daunting endeavor. However, understanding the intricacies of a particular company and its share performance can lead to informed investment decisions. This article aims to provide a detailed analysis of PP Jewellers, a prominent player in the Indian jewelry industry, with a focus on its share performance and potential investment opportunities.

PP Jewellers: A Brief Overview

PP Jewellers, a leading jewelry retailer in India, has established itself as a trusted brand known for its exquisite designs, quality craftsmanship, and wide range of products. The company operates a network of retail stores across various states, catering to a diverse customer base. Its business model focuses on offering a seamless shopping experience, encompassing a comprehensive range of jewelry, from traditional to contemporary designs, at competitive prices.

Understanding PP Jewellers Share

When you invest in PP Jewellers share, you are essentially purchasing a small ownership stake in the company. This ownership entitles you to a portion of the company’s profits, known as dividends, and the potential for capital appreciation as the share price increases over time.

Factors Influencing PP Jewellers Share Performance

Several factors can influence the performance of PP Jewellers share, including:

- Economic Conditions: The overall economic climate significantly impacts consumer spending, which, in turn, affects jewelry demand. Factors like inflation, interest rates, and GDP growth play a crucial role in determining the company’s financial performance.

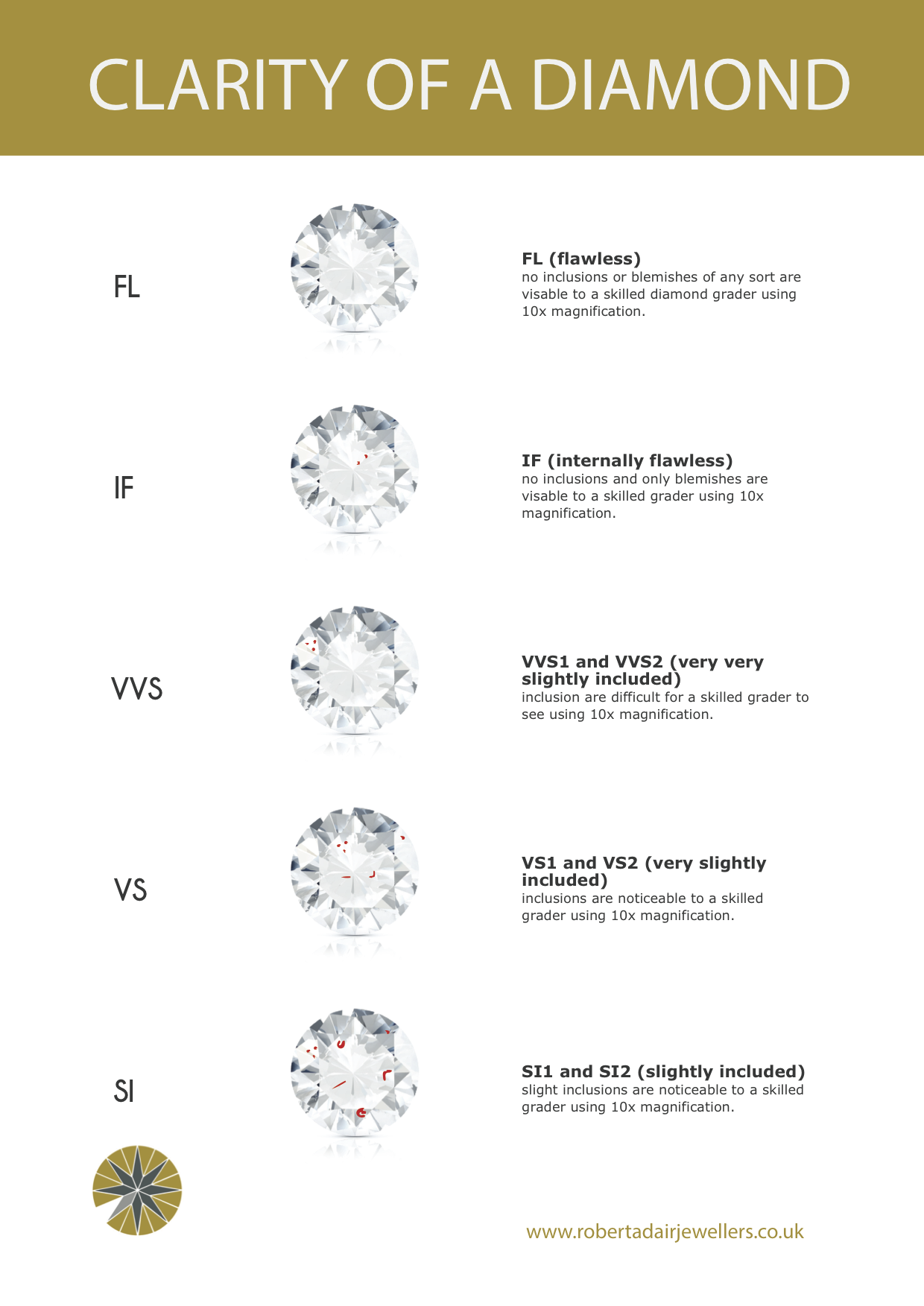

- Gold Price Fluctuations: As a primary raw material for jewelry, gold prices significantly impact the cost of production and, consequently, the profitability of jewelry retailers like PP Jewellers.

- Competition: The Indian jewelry market is highly competitive, with numerous players vying for market share. The company’s ability to differentiate itself through product offerings, pricing strategies, and customer service significantly impacts its share performance.

- Consumer Preferences: Changing consumer preferences and evolving trends in jewelry design can influence demand for specific products. PP Jewellers’ ability to adapt to these trends and cater to evolving tastes is crucial for its success.

- Government Policies: Regulations and policies related to the jewelry industry, such as import duties and taxes, can impact the company’s operations and profitability.

Analyzing PP Jewellers Share Performance

To understand the historical performance of PP Jewellers share, it is crucial to analyze various financial metrics and trends:

- Earnings Per Share (EPS): This metric reflects the company’s profitability and indicates the amount of profit attributable to each outstanding share. A growing EPS suggests a healthy financial performance and potential for share price appreciation.

- Price-to-Earnings Ratio (P/E): This ratio compares the company’s share price to its earnings per share. A high P/E ratio suggests that investors are willing to pay a premium for the company’s shares, indicating strong growth potential.

- Dividend Yield: This metric represents the annual dividend payment as a percentage of the share price. A higher dividend yield indicates a greater return on investment for shareholders.

- Debt-to-Equity Ratio: This ratio reflects the company’s financial leverage and indicates the proportion of debt financing used compared to equity. A high debt-to-equity ratio can indicate a higher risk for investors.

Investment Considerations for PP Jewellers Share

Before making any investment decision, it is crucial to consider the following factors:

- Risk Tolerance: Investors with a high risk tolerance may be willing to invest in PP Jewellers share, recognizing the potential for both significant gains and losses.

- Investment Horizon: The time frame for holding the shares significantly impacts investment returns. A long-term investment horizon can mitigate short-term market fluctuations and allow for potential capital appreciation.

- Diversification: Diversifying your investment portfolio across different asset classes and industries can help mitigate risk and enhance overall returns.

FAQs about PP Jewellers Share

Q1. Is PP Jewellers share a good investment?

A. Whether PP Jewellers share is a good investment depends on individual investment goals, risk tolerance, and market conditions. It is essential to conduct thorough research and consider the factors discussed earlier before making any investment decision.

Q2. How can I buy PP Jewellers share?

A. You can buy PP Jewellers share through a registered stockbroker or online trading platform. These platforms allow you to place orders for buying and selling shares, facilitating the investment process.

Q3. What are the potential risks associated with investing in PP Jewellers share?

A. As with any investment, investing in PP Jewellers share carries inherent risks, including:

- Market Volatility: Share prices can fluctuate significantly due to various factors, including economic conditions, company performance, and investor sentiment.

- Competition: Intense competition in the jewelry industry can impact the company’s profitability and share performance.

- Gold Price Fluctuations: Gold price volatility can directly impact the cost of production and the company’s financial performance.

Tips for Investing in PP Jewellers Share

- Thorough Research: Conduct extensive research on the company’s financials, industry trends, and competitive landscape before making any investment decision.

- Consider Investment Goals: Align your investment strategy with your financial goals and risk tolerance.

- Monitor Performance: Regularly track the company’s performance and market conditions to assess the investment’s viability.

- Seek Professional Advice: Consult with a financial advisor to obtain personalized investment guidance and navigate complex market dynamics.

Conclusion

PP Jewellers, with its strong brand recognition and established presence in the Indian jewelry market, presents an attractive investment opportunity for discerning investors. However, it is crucial to recognize the inherent risks associated with any investment and conduct thorough research before making any investment decisions. By carefully analyzing the factors discussed earlier, investors can make informed choices that align with their financial goals and risk tolerance, potentially reaping the rewards of investing in PP Jewellers share.

Closure

Thus, we hope this article has provided valuable insights into A Comprehensive Guide to Understanding and Investing in PP Jewellers: A Detailed Analysis. We thank you for taking the time to read this article. See you in our next article!