The Platinum Price Journey: A Comprehensive Look at Historical Fluctuations

Related Articles: The Platinum Price Journey: A Comprehensive Look at Historical Fluctuations

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to The Platinum Price Journey: A Comprehensive Look at Historical Fluctuations. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

The Platinum Price Journey: A Comprehensive Look at Historical Fluctuations

Platinum, a precious metal prized for its rarity, durability, and versatility, has a fascinating history that mirrors global economic and political events. Its price has fluctuated significantly over the years, influenced by factors such as supply and demand, industrial applications, investment sentiment, and geopolitical tensions. Understanding these historical price movements offers valuable insights into the forces that shape the platinum market and its potential future trajectory.

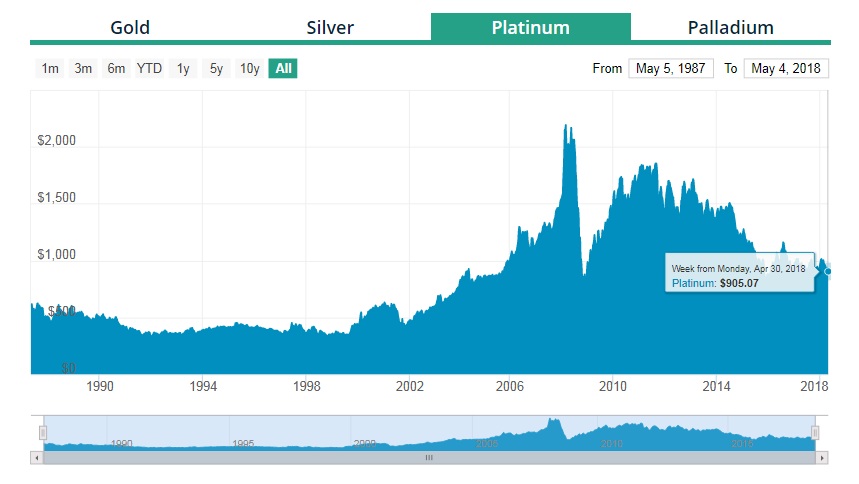

The Early 20th Century: A Steady Rise

The early 20th century saw platinum prices steadily increase, driven by growing industrial demand. The metal’s resistance to corrosion and high melting point made it ideal for use in various industries, including automotive, electrical, and jewelry. The discovery of platinum deposits in South Africa in the late 19th century further contributed to its increased availability and use.

The Post-World War II Boom

The period following World War II witnessed a surge in platinum demand, fueled by the rapid industrialization and economic expansion of developed nations. This led to a significant rise in platinum prices, further propelled by the increasing popularity of platinum jewelry, particularly in the United States.

The 1970s: A Time of Volatility

The 1970s marked a turbulent period for platinum prices, characterized by significant fluctuations. The oil crisis of 1973, coupled with political instability in South Africa, the primary producer of platinum, led to supply disruptions and price spikes. However, the market eventually stabilized, with prices settling at a higher level than before the crisis.

The 1980s and 1990s: A Period of Consolidation

The 1980s and 1990s witnessed a period of relative price stability for platinum. While prices fluctuated, they remained within a defined range, influenced by a combination of factors such as industrial demand, investment sentiment, and the emergence of new platinum mines.

The 21st Century: A Rollercoaster Ride

The 21st century has been marked by significant price volatility for platinum, influenced by a confluence of global events and market dynamics.

The 2000s: A Bull Market

The early 2000s saw a remarkable surge in platinum prices, driven by strong demand from emerging economies, particularly China, and increased investment interest. The metal’s perceived safe-haven status during periods of economic uncertainty further fueled its price appreciation.

The 2010s: A Challenging Decade

The 2010s proved to be a more challenging decade for platinum prices, as several factors weighed on the market. The global financial crisis of 2008 led to a sharp decline in demand, while the rise of diesel-powered vehicles, a key application for platinum, slowed down due to environmental regulations. Additionally, the increased production of platinum from Russia and South Africa contributed to supply pressures, leading to a period of price consolidation.

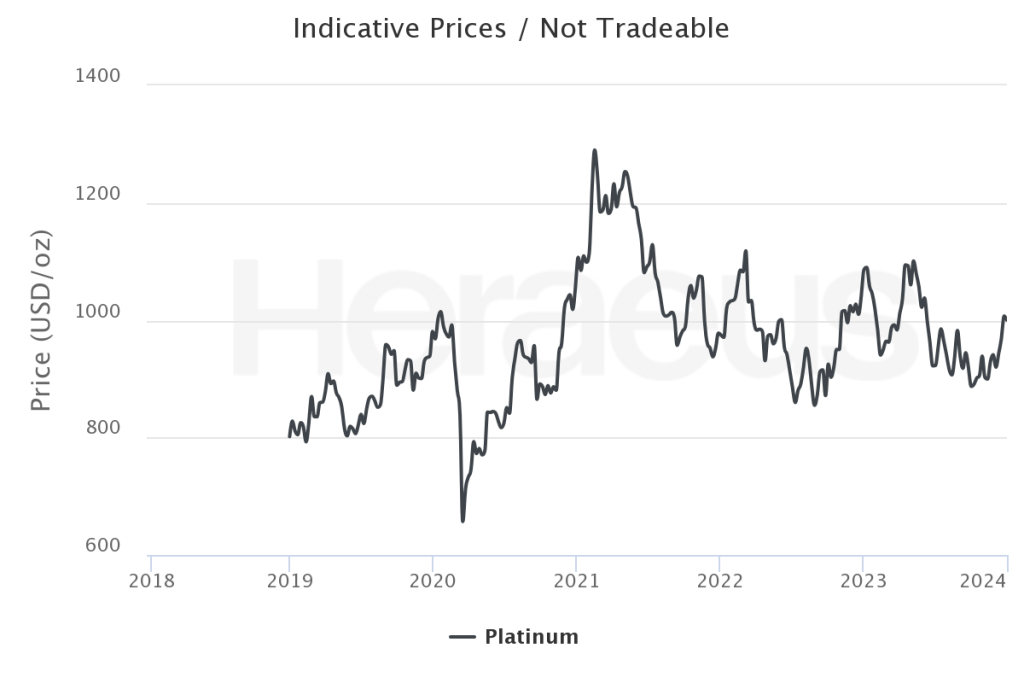

The 2020s: A Time of Uncertainty

The 2020s have begun with a renewed focus on platinum’s role in the transition towards a cleaner energy future. The metal is a key component in catalytic converters used in gasoline-powered vehicles and is also essential in fuel cells, which are seen as a potential solution for reducing carbon emissions. However, the ongoing global economic uncertainty and geopolitical tensions continue to influence the platinum market, creating a volatile environment for prices.

Key Factors Influencing Platinum Prices

Several factors contribute to the fluctuations in platinum prices. Understanding these factors is crucial for investors and market participants seeking to navigate the platinum market:

- Supply and Demand: The balance between supply and demand is a fundamental driver of platinum prices. Increased production or decreased demand can lead to price declines, while reduced production or increased demand can push prices higher.

- Industrial Applications: Platinum’s diverse industrial applications, ranging from automotive to electronics and jewelry, significantly influence its demand and price. Changes in production levels or technological advancements in these industries can impact platinum prices.

- Investment Sentiment: Investor sentiment plays a crucial role in platinum prices. During periods of economic uncertainty, investors often seek safe-haven assets, including platinum, which can lead to price increases. Conversely, negative market sentiment can result in price declines.

- Geopolitical Factors: Political instability, particularly in major platinum-producing countries like South Africa and Russia, can disrupt production and supply chains, leading to price fluctuations.

- Government Policies: Government policies, such as environmental regulations and incentives for clean energy technologies, can impact platinum demand and prices.

The Importance of Platinum

Platinum’s unique properties and diverse applications make it a vital metal with significant economic and societal importance. Its resistance to corrosion, high melting point, and catalytic properties make it indispensable in various industries, including:

- Automotive: Platinum is a key component in catalytic converters, which reduce harmful emissions from gasoline-powered vehicles.

- Electronics: Platinum is used in electronic devices, such as smartphones and computers, due to its high conductivity and resistance to corrosion.

- Jewelry: Platinum’s durability and lustrous appearance make it a popular choice for jewelry, particularly engagement rings and other high-value pieces.

- Medicine: Platinum compounds are used in chemotherapy drugs for treating various types of cancer.

- Fuel Cells: Platinum is a crucial component in fuel cells, which convert hydrogen gas into electricity, offering a clean and efficient energy source.

Platinum’s Role in a Sustainable Future

As the world transitions towards a more sustainable energy future, platinum is poised to play a pivotal role. Its use in fuel cells and other clean energy technologies is expected to drive demand growth in the coming years. Furthermore, platinum’s role in reducing emissions from gasoline-powered vehicles aligns with global efforts to combat climate change.

FAQs About Platinum Price History

Q: What are the main reasons for the price fluctuations in platinum?

A: Platinum price fluctuations are primarily driven by factors such as supply and demand, industrial applications, investment sentiment, geopolitical events, and government policies.

Q: How has the demand for platinum evolved over time?

A: The demand for platinum has evolved significantly over time, driven by factors such as industrial growth, technological advancements, and changes in consumer preferences. Its use in automotive, electronics, jewelry, and clean energy technologies continues to shape its demand profile.

Q: What are the key factors influencing platinum supply?

A: Platinum supply is influenced by factors such as mine production, recycling rates, and geopolitical stability in major producing countries.

Q: How does investment sentiment impact platinum prices?

A: Investment sentiment plays a crucial role in platinum prices, particularly during periods of economic uncertainty. Investors often seek safe-haven assets, including platinum, which can lead to price increases.

Q: What are the potential future trends for platinum prices?

A: The future of platinum prices depends on various factors, including global economic growth, technological advancements, and government policies. The increasing demand for platinum in clean energy technologies and the potential for increased investment interest could lead to price appreciation in the long term.

Tips for Investing in Platinum

- Understand the fundamentals: Before investing in platinum, it is essential to understand the factors influencing its price, including supply and demand, industrial applications, and investment sentiment.

- Consider your investment goals: Determine your investment objectives and risk tolerance before investing in platinum.

- Diversify your portfolio: Platinum should be considered as part of a diversified investment portfolio, rather than a sole investment.

- Invest through reputable sources: Choose reputable brokers or investment platforms to buy and sell platinum.

- Stay informed: Keep abreast of market developments and news related to platinum to make informed investment decisions.

Conclusion

The price history of platinum offers valuable insights into the forces that shape the metal’s market dynamics. From its steady rise in the early 20th century to its volatile fluctuations in the 21st century, platinum’s price has been influenced by a complex interplay of factors, including supply and demand, industrial applications, investment sentiment, and geopolitical events. As the world transitions towards a more sustainable future, platinum’s role in clean energy technologies is expected to drive demand growth, potentially leading to price appreciation in the long term. However, investors should carefully consider the risks and uncertainties associated with platinum before making any investment decisions.

![Platinum Prices – Historical Graph [Realtime Updates]](https://procurementtactics.com/wp-content/uploads/2023/03/Platinum-Prices-1.jpg)

Closure

Thus, we hope this article has provided valuable insights into The Platinum Price Journey: A Comprehensive Look at Historical Fluctuations. We thank you for taking the time to read this article. See you in our next article!